The investment decision

Any investment decision is broadly broken down into two main components; Risk and Reward. The concept of reward is fairly simple and as a result most investment houses typically focus on this aspect of an investment when selling financial products. It is the potential upside of an investment that is usually highlighted in advertisements. Unfortunately risk and uncertainties are not generally given the attention they deserve and indeed are often left overlooked. It is exactly this asymmetry in the investment process that Analyse Risk seeks to redress to provide its clients with a fair and balanced analysis to help them make informed decisions. By working with your wealth manager or your financial advisor, Analyse Risk can give valuable insight into how portfolio risk dynamics will behave in an often uncertain world; insight that will help ensure that your portfolio is protected.

Considering risk adjusted return

When considering any investment, an investor should consider the expected return on a risk-adjusted basis. In simple terms, this means measuring expected return adjusted for the possible losses associated with an investment. The result is a number that can then be used to fully gauge if an investment truly matches an individual’s preference for risk. While it is obvious that every individual has a preference for reward and unhindered would have as much of it as he she could, it is really the preference for risk that drives the investment decision. This concept, however, makes the selling of financial products more difficult for a typical bank or pension fund and this is one of the reasons why the marketing of financial products tends to be so one sided toward reward.

In order to help clients make truly balanced decisions, large financial institutions would really need to understand each individual client’s preference for risk. Unfortunately typical investment products are designed to be sold en-mass where risk is aggregated across a market segment rather than applied to an individual. Clearly, IFAs and wealth managers can help select which investment products are best suited to a particular investor but this part of the investment process can be flawed without a detailed risk assessment and analysis of not only how much the product should return but how the risks of that product will evolve over time and under a range of market conditions. Moreover, products must be tailored to fit into a portfolio of investments in order to ensure that risk does not build up, hidden to the investor. No two investors are alike and it is exactly this principle that forms the basis of Analyse-Risk’s bespoke and tailored client reporting - we help each individual client understand the true risks inherent in their investments.

The risks they never told you about

With an understanding of how important risk is in the investment decision and how each individuals risk profile if unique, we list some of the common risks found in typical retail investment products as well as what we highlight for clients in our reporting:

Fees

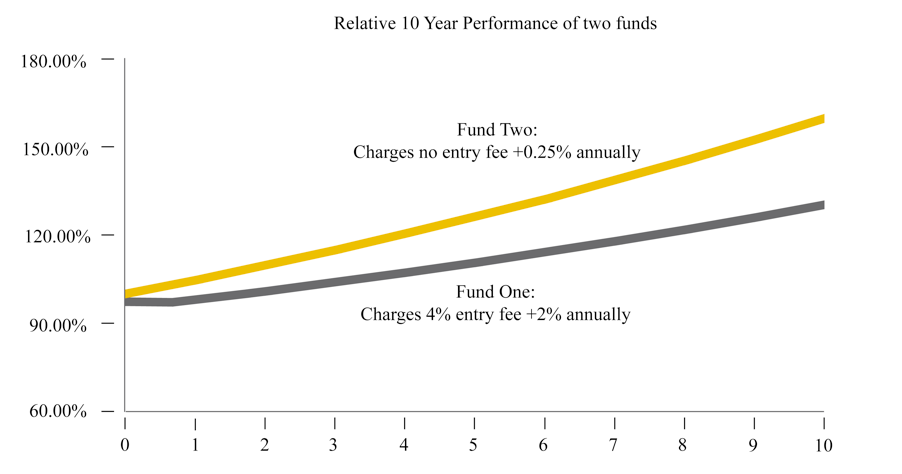

Arguably one of the biggest destroyers of long term wealth: hidden fees and charges can substantially affect the long-term performance and health of an investment. Financial products can be marketed “GROSS” of fees which in simple terms means that while the performance of your investment indicates it may have returned 20%, the real “NET” return to the you can be substantially lower once the fees have been deducted. Over time, the effect can be staggering. To illustrate this effect, we have created a hypothetical investment that grows at 5% p.a. for 10 years with an annual fee of 2% and an upfront investment fee of 4%. This fund is compared to a comparative product investing in the same underlying assets and grows at the same rate but has an annual fee of 0.25% p.a. and no upfront fee.

Liquidity risk

Do you know or understand how liquid your investments really are? Liquidity represents how easily your investments can be turned into cold hard cash when you need it. Typically banks and Insurance companies prefer to lock up investor money where possible to manage their liabilities and make return or fees on client capital. To encourage this lockup they may impose heavy fees on redemption or only return part of your investment when you want it back. Advice can be vague and misleading particularly to the question “Can I get my money back any time?”. A “Yes” answer can contain a myriad of conditions and complications. For example many policies and plans require a written submission to a plan provider and this process can take weeks to complete.

Even if you do intend to invest in for a long period of time, investing in illiquid products can have seriously adverse effect on the end value of your investment. When financial markets stress, it is usually illiquid products that lose most value fastest as investors rush to safer assets easily convertible into cash. The concept and consequences of liquidity is rarely explained to first time investors but the results can be significant up to and including total loss of portfolio value.

Gap risk

Financial markets, like the stock market, are commonly understood to move up and down over time and typical products are usually sold with this risk in mind. What may not necessarily be put forward is the idea of Gap or Stress risk. When financial markets are under stress the up and down movements can be extremely violent. When markets are in these extreme situations it is critical that investors have an understanding of how their financial assets will react or behave. While many investment houses will talk about the idea of a “risky” or “high risk” investment, rarely do they quantify this risk to give an investor a better understanding as to what exactly qualifies “high risk” or “medium risk”. Again, Analyse Risk can work with your advisor to help you gain a clear understanding of how your investments will behave in a range of market conditions and guide, inform and warn you of impending dangers.

As with liquidity risk, when markets stress, there is generally a flight to quality whereby investors move out of riskier assets into safer assets easily converted into cash. This has a cascade affect which puts further downward pressure on the price of riskier assets. It is critical investors understand what happens to their financial products when this cascade effect occurs and if recovery of asset value is even possible when and if the market turns up again; recovery is not always guaranteed and some products are more susceptible to this effect than others.

Legal risk

Financial products are usually sold under many terms and conditions that investors agree to when signing an intention or agreement to invest. It is imperative clients know and understand exactly what they are signing into as well as the implication and risks of where things can go wrong. Most people will skim over the fine print either because it is too cumbersome or not easily understood. It is often difficult to reverse an agreement once entered into. Investors should know if a product they have bought has certain restrictions such as not being able to withdraw funds, hefty penalties, or complete loss of value when certain events are triggered, this is because it can be almost impossible to withdraw without penalty.

Currency risk

It is imperative that clients understand the true currency risk they run in the products they are invested in. Most international funds, for example, are sold as either Dollar, Pound, or Euro denominated. This does not mean the underlying asset’s the fund invests in are in the same currency as the fund itself. An example would be a US Dollar denominated Thai stock fund. In the event the Thai currency collapsed, although the fund is based in US dollars, the actual US dollars returned to the investor at the end of the day could be substantially less than what the investor initially put in, even if the stocks had increased in value themselves over time. Another example would be high interest rates offered by Banks in foreign currency. Although you may earn a higher interest rate, if the currency of the deposit depreciates against your local currency you could end up losing money overall even with the higher interest rate.

Other risks

Risk is a very broad subject but at Analyse-Risk, in addition to the above, we assess a multitude of other risk factors and explain their possible impacts succinctly including:

Concentration Risk (Are you diversified enough?)

Fund Manager Style Drift (Are your funds acting the way they should?)

Scenario Risk (If certain events were to occur, what is the likely impact on your portfolio?)

Political Risk (What political risk could affect your portfolio?)

Please remember, the above list is not exhaustive and we pride in tailoring our analysis to the individual.